Investing in gold has long been a favored strategy for preserving wealth and securing financial stability. Among the various gold investment options available, the 10g gold bar stands out as a popular choice for both new and experienced investors. This article explores the benefits, considerations, and tips for investing in a 10g gold bar, making it an accessible and practical option for those looking to diversify their portfolio.

Why Choose a 10g Gold Bar?

Affordability: The 10g gold bar is an affordable entry point for gold investment. It allows investors to start building their gold holdings without the significant capital outlay required for larger bars. This makes it an ideal option for beginners or those with a limited budget.

Liquidity: Smaller gold bars like the 10g gold bar are highly 10g gold bar liquid. Their lower price point compared to larger bars means there is a larger pool of potential buyers, making them easier to sell or trade when needed.

Flexibility: Investing in multiple 10g gold bars offers greater flexibility compared to a single large bar. Investors can sell smaller quantities as needed, without having to liquidate a more substantial investment.

Diversification: Adding 10g gold bars to your investment portfolio enhances diversification. Gold often moves independently of other financial instruments, providing a hedge against market volatility and inflation.

Portability and Storage: The 10g gold bar is compact and easy to store. Its small size allows for convenient home storage, secure bank safe deposit boxes, or professional vault services without requiring extensive space.

Understanding the 10g Gold Bar

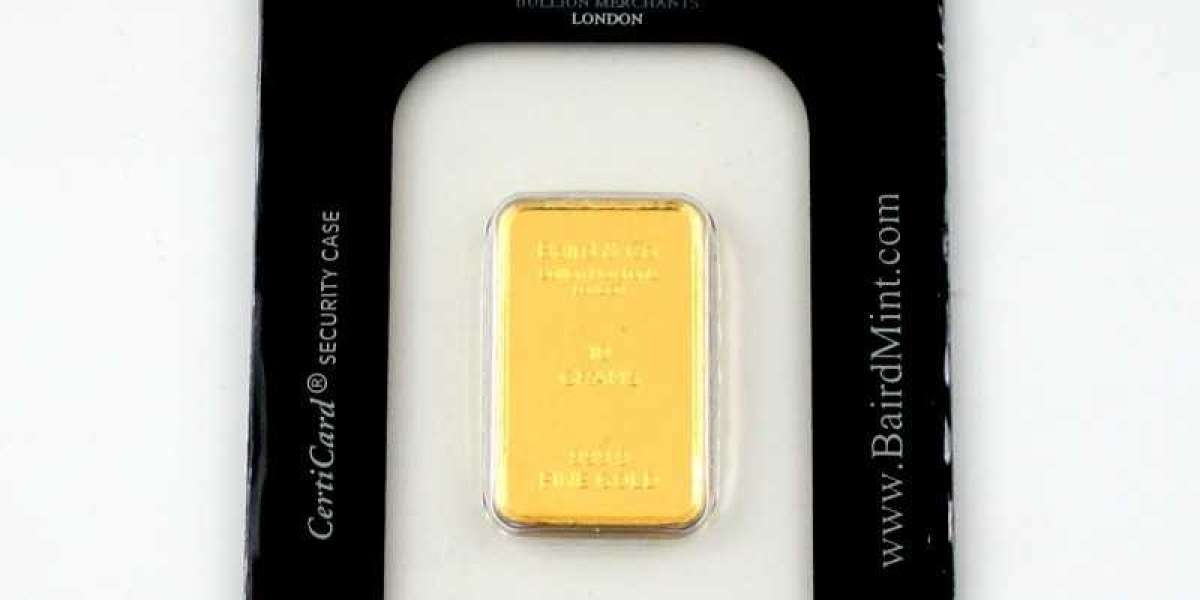

A 10g gold bar typically boasts a high purity level, often 99.99% (24-karat), ensuring you are investing in nearly pure gold. These bars are produced by reputable mints and refiners, which provide certificates of authenticity and unique serial numbers to guarantee the gold's purity and origin.

Popular Brands and Mints

When purchasing a 10g gold bar, it is essential to choose products from reputable mints and brands to ensure quality and authenticity. Some of the most trusted names in the industry include:

PAMP Suisse: Known for their exquisite designs and high standards, PAMP Suisse gold bars are highly regarded. Their 10g gold bars often feature the iconic Fortuna design and come with a certificate of authenticity.

Valcambi: A leading Swiss refinery, Valcambi produces 10g gold bars known for their quality and craftsmanship. These bars often feature the Valcambi logo and are packaged securely.

Perth Mint: Australia’s Perth Mint offers 10g gold bars that combine aesthetic appeal with investment value. Their bars come with advanced security features and a certificate of authenticity.

Credit Suisse: This Swiss financial institution produces 10g gold bars that are trusted worldwide. Their bars are known for their purity and reliability, often accompanied by a certificate of authenticity.

How to Buy a 10g Gold Bar

Research Reputable Dealers: Ensure you purchase from reputable dealers with a solid track record. Look for reviews, customer feedback, and industry reputation to avoid counterfeit products.

Verify Purity and Certification: Check the purity of the gold bar (preferably 99.99%) and ensure it comes with a certificate of authenticity from the mint.

Understand Pricing: Gold bars are sold at a premium above the spot price of gold. This premium covers manufacturing, distribution, and dealer margins. Compare premiums from different dealers to get the best deal.

Consider Storage Options: Decide where you will store your gold bar. Options include home safes, bank safe deposit boxes, and professional vault services. Each has its pros and cons in terms of security and accessibility.

Selling Your 10g Gold Bar

When the time comes to sell, the 10g gold bar's liquidity works in your favor. Ensure you sell to reputable dealers who offer fair market prices. Having proper documentation, including the certificate of authenticity, will facilitate the selling process and help you get the best price.

Tips for First-Time Buyers

Set a Budget: Determine how much you are willing to 10g gold bar invest and stick to your budget. The 10g gold bar represents a manageable investment, making it easier to stay within your financial limits.

Stay Informed: Keep track of gold market trends and prices to make informed purchasing decisions. Knowledge of market conditions can help you buy at optimal times.

Authenticate Your Purchase: Ensure that your gold bar is genuine by buying from reputable sources and checking for certification and security features.

Plan for Storage: Decide in advance where and how you will store your gold. Proper storage ensures the longevity and safety of your investment.

Conclusion

The 10g gold bar is a versatile and valuable addition to any investment portfolio. Its balance of affordability, liquidity, and ease of storage makes it an attractive choice for both new and seasoned investors. By choosing reputable dealers, understanding the market, and considering proper storage options, you can confidently invest in 10g gold bars and enjoy the stability and security they offer. Whether you are looking to diversify your assets, protect against inflation, or simply add a reliable investment to your portfolio, the 10g gold bar is an excellent choice.