In the ever-evolving world of cryptocurrency, securing your digital assets is paramount. One of the most effective methods to achieve this is through the use of cold wallets. But what exactly are cold wallets, and how do they differ from other types of wallets? This guide aims to provide a comprehensive understanding of cold wallets and their significance in safeguarding your cryptocurrency investments.

What Are Cold Wallets?

Cold wallets, also known as cold storage, refer to cryptocurrency wallets that are not connected to the internet. This disconnection from the web makes them less vulnerable to hacking attempts and cyber threats. Unlike hot wallets, which are online and more convenient for frequent transactions, cold wallets prioritize security over accessibility.

Types of Cold Wallets

There are several types of cold wallets available, each with its unique features:

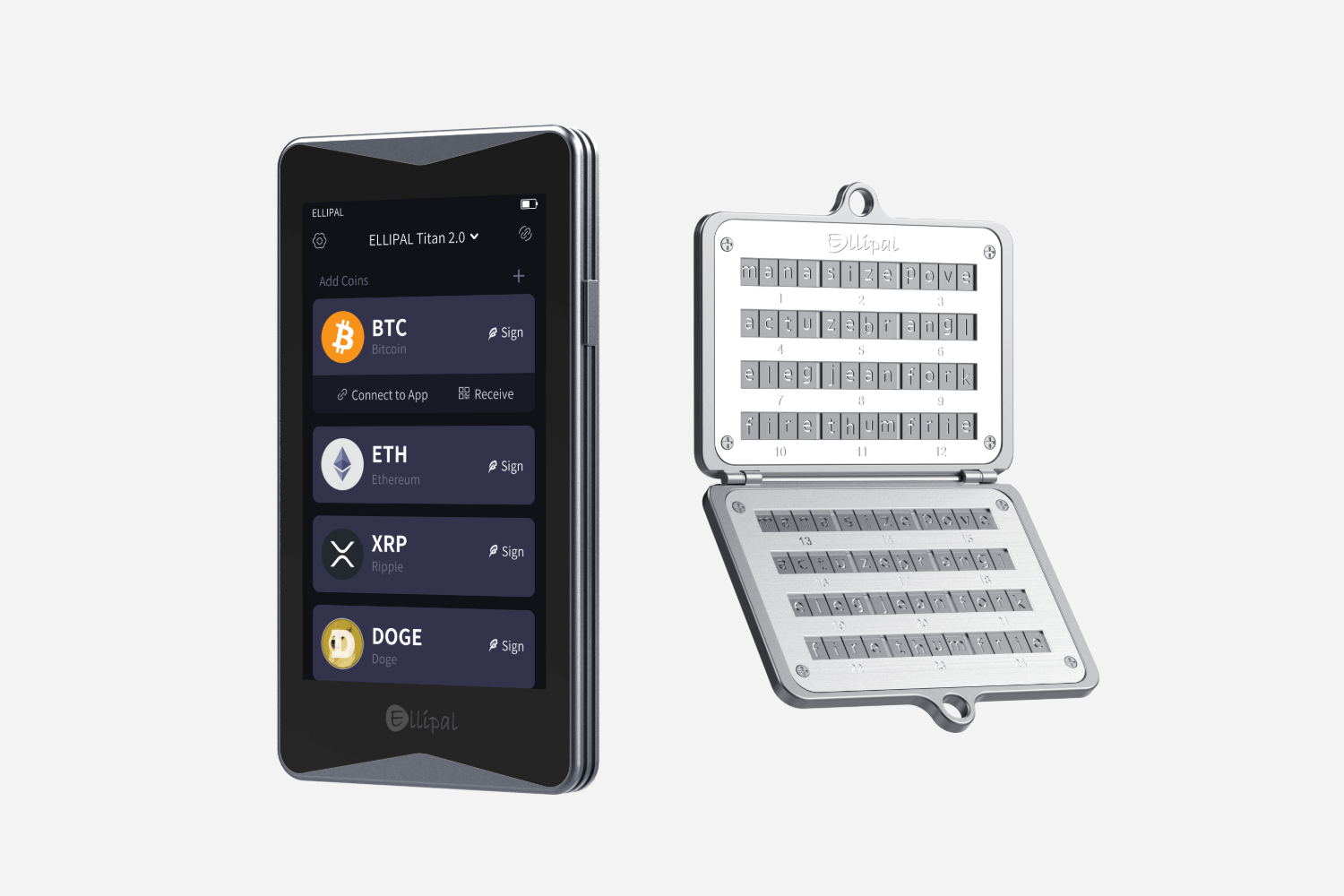

- Hardware Wallets: These are physical devices designed specifically for storing cryptocurrencies securely. Examples include the Ledger Nano S and Trezor.

- Paper Wallets: A paper wallet is a physical document that contains your public and private keys. It is generated offline and can be printed out for safe keeping.

- Air-Gapped Wallets: These wallets are completely isolated from any network. They often involve using a device that has never been connected to the internet.

Why Use Cold Wallets?

Using cold wallets offers several advantages for cryptocurrency holders:

- Enhanced Security: Cold wallets provide a higher level of security against online threats.

- Protection from Theft: Since they are offline, cold wallets are immune to hacking and phishing attacks.

- Long-Term Storage: They are ideal for investors looking to hold their assets for an extended period without the need for frequent access.

How to Choose the Right Cold Wallet

When selecting a cold wallet, consider the following factors:

- Security Features: Look for wallets that offer robust security measures, such as two-factor authentication and encryption.

- User Experience: Choose a wallet that is easy to use, especially if you are new to cryptocurrency.

- Compatibility: Ensure that the wallet supports the cryptocurrencies you intend to store.

Best Practices for Using Cold Wallets

To maximize the security of your cold wallet, follow these best practices:

- Regularly update the firmware of your hardware wallet.

- Store your recovery phrases in a secure location.

- Consider using a combination of different cold wallets for diversified security.

For those looking for a reliable hardware wallet, consider the . This device offers advanced security features and user-friendly functionality, making it an excellent choice for both beginners and experienced users.

Conclusion

In conclusion, cold wallets are an essential tool for anyone serious about protecting their cryptocurrency assets. By understanding the different types of cold wallets and implementing best practices, you can significantly reduce the risk of losing your investments. As the cryptocurrency landscape continues to grow, prioritizing security through cold wallets will remain a critical component of asset management.